Throughout the post, I’ve woven in links to related content on our site: Nvidia’s AI Dominance: A Deep Dive, S&P 500 Trends: Weekly Roundup, and Fed Rate Cuts: What Traders Need to Know.

Main Body

Wall Street’s trading floor hummed with that familiar pre-earnings tension this morning, the kind where every glance at a screen feels like peering into a crystal ball. After a string of down days, major indices are showing faint signs of life, with futures pointing to a modest open amid broader questions about tech’s staying power.

Futures Point to a Cautious Rebound

US stock futures leaned slightly higher early Wednesday, a subtle shift after tech-heavy selling dragged benchmarks lower for days on end. The S&P 500 futures climbed 0.36%, while Nasdaq 100 futures rose 0.43%. Dow futures, ever the steady hand, nudged up just 0.13% to around 46,242. It’s not exactly fireworks, but in this environment, even a flicker feels like progress.

This comes on the heels of four straight declines for the Dow and S&P 500, with the Nasdaq marking its fifth drop in six sessions. Investors, it seems, are dialing back on risk after a blistering run-up in megacaps. For more on the broader index performance, check our S&P 500 Trends: Weekly Roundup.

Nvidia’s Big Reveal: The AI Trade’s Next Chapter

All eyes are on Nvidia after the bell today—its third-quarter results could swing the stock by up to 7%, translating to a staggering $300 billion shift in market cap. Options traders are bracing for volatility, but whispers of profit-taking in the chip giant suggest some are wondering if AI hype has priced in too much perfection. Nvidia’s been the poster child for the bull market, but with valuations stretched, tonight’s numbers will test if the momentum holds. Dive deeper into the chipmaker’s story via our Nvidia’s AI Dominance: A Deep Dive.

Retail Earnings: A Pulse Check on Holiday Shoppers

Before the open, we’ll get quarterly updates from big-box players like Target, Lowe’s, and TJX Companies. These reports arrive at a pivotal moment, with economic data still trickling in post-government shutdown. Holiday spending vibes? These could be our best clue yet on whether consumers are opening wallets or tightening belts. TJX, for one, edged up 0.28% in premarket, hinting at resilience in discount retail.

For context on consumer trends, outbound link to Yahoo Finance’s latest retail sector analysis.

Bitcoin’s Rollercoaster: From Moonshot to Meh

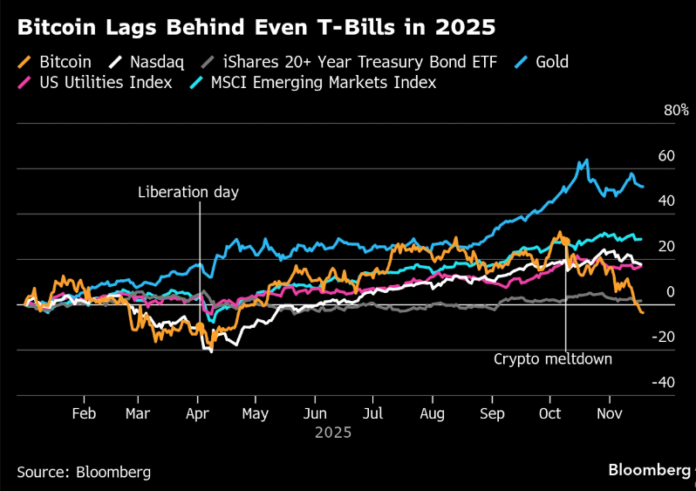

Over in crypto land, bitcoin clawed back above $90,000 after a brief scare below that mark—a reminder that even “digital gold” isn’t immune to risk-off moods. It’s down nearly 30% from its 2025 peak, underperforming everything from Treasurys to gold and even sleepy utilities stocks. Bloomberg’s take nails it: the token’s failing on its promises as an inflation hedge or uncorrelated asset. In portfolios, it’s not delivering the diversification punch anymore.

Outbound link for the full crypto breakdown: Bloomberg’s 2025 Bitcoin Underperformance Report.

Thursday’s Jobs Data: Fed’s December Dilemma

Looking ahead, the delayed September jobs report drops tomorrow—the first big economic read post-shutdown. It could tip the scales on Fed rate cut odds for December, where traders are split down the middle. Strong numbers? Pause the easing. Weak? More cuts incoming. For policy wonks, our Fed Rate Cuts: What Traders Need to Know breaks it down.

In the end, today’s market feels like a deep breath before the plunge—cautious, calculated, and full of “what ifs.” I’ll be watching Nvidia closely; if it delivers, we might just see that AI trade roar back. What’s your play heading into earnings? Drop a comment below.

This post was updated on November 19, 2025, at 3:57 PM GMT+5:30. Market data via CBOT delayed quotes.